The Basics of Cost Accounting Explained Simply

Understand cost accounting with ease. Learn how accounting and bookkeeping service for startups can help track costs and boost profits.

Understand cost accounting with ease. Learn how accounting and bookkeeping service for startups can help track costs and boost profits.

Understanding where your money goes is key to building a profitable business. For startups especially, every rupee counts. Thats why working with a trusted accounting and bookkeeping service for startups is one of the smartest decisions you can make.

At Ceptrum, we equip new businesses with structured financial systems, helping them track costs, make informed decisions, and scale with confidence.

How an Accounting and Bookkeeping Service for Startups Simplifies Cost Accounting

Startups often juggle limited budgets, small teams, and rapid growthall while trying to stay financially healthy. An expert accounting and bookkeeping service for startups helps build cost systems that are accurate, efficient, and aligned with long-term business goals.

Our team at Ceptrum goes beyond bookkeeping. We create financial clarity through smart categorization, real-time reports, and tailored support for founders who want to scale efficiently.

Key Elements of Cost Accounting for Startups

1. Fixed vs. Variable Costs

-

Fixed costs: Stay the same regardless of business activity (e.g. rent, salaries).

-

Variable costs: Change with production or service levels (e.g. raw materials, packaging). Understanding these helps in budgeting and profitability forecasting.

2. Direct vs. Indirect Costs

-

Direct costs can be tied to a specific product (e.g. parts, labor).

-

Indirect costs support overall operations (e.g. electricity, admin expenses). Distinguishing both types improves pricing strategy and financial reporting.

3. Cost Allocation

Assigning costs to the correct departments or products gives insight into whats driving (or draining) profit. Ceptrum uses proven allocation methods to improve decision-making.

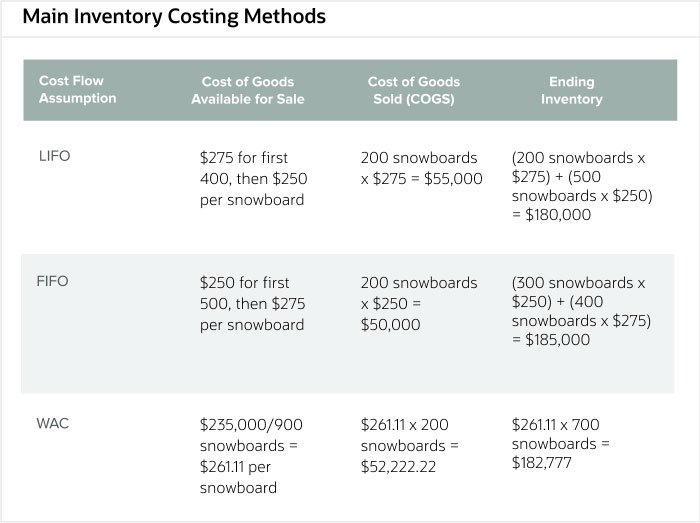

4. Inventory Costing Methods

Startups selling physical goods must choose how to value inventory:

-

FIFO (First In, First Out)

-

LIFO (Last In, First Out)

-

Weighted Average We help determine what suits your business bestbalancing cash flow and taxes.

5. Break-Even and CVP Analysis

Cost-Volume-Profit (CVP) analysis shows how sales volume and costs affect profit. With this tool, you can answer:

-

When will my business break even?

-

How will a price change affect profit?

-

Ceptrum includes CVP insights in all its startup service packages.

Why Choose Ceptrum for Your Startups Accounting?

-

? We specialize in cost systems for startups, not just basic bookkeeping.

-

? Cloud-based tools for real-time access and clean recordkeeping

-

? Personalized support from startup financial experts

-

? Scalable services that grow with your business

-

? Monthly reports that make sense, even if youre not a numbers person

We're not just a servicewe're your financial partner in growth.

Ready to Get Smart About Startup Costs?

Let Ceptrum help you build a cost accounting system that brings clarity, control, and confidence.

FAQs:

1. Do I need cost accounting if Im a service-based startup?

Yes! Even if youre not selling physical products, you still have overheads, labor costs, and project-based expenses to track.

2. How soon should I set up cost accounting for my business?

Right away. The earlier you build a smart system, the easier it is to scale and avoid costly mistakes.

3. Can Ceptrum help me choose the right accounting tools?

Absolutely. We recommend and help set up cloud-based solutions tailored to your business needs.

4. How does cost accounting help with investor reporting?

It provides detailed insights into margins, burn rate, and profitabilitykey metrics investors care about.

5. Whats the first step to working with Ceptrum?

Just reach out! Well assess your needs and recommend a plan that fits your budget and stage.